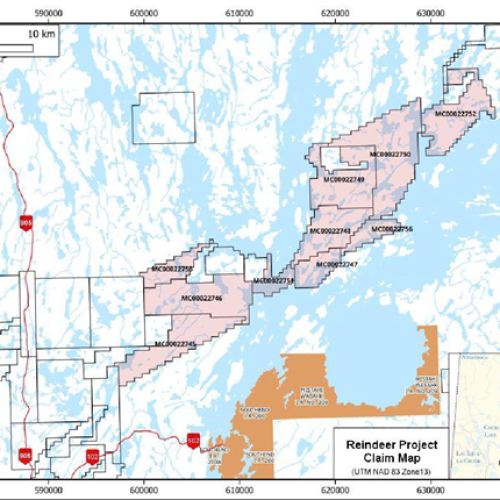

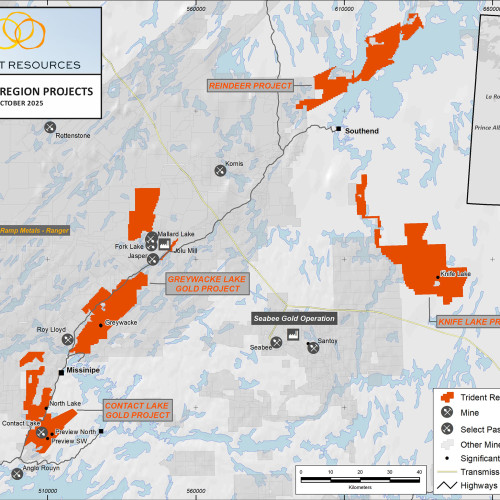

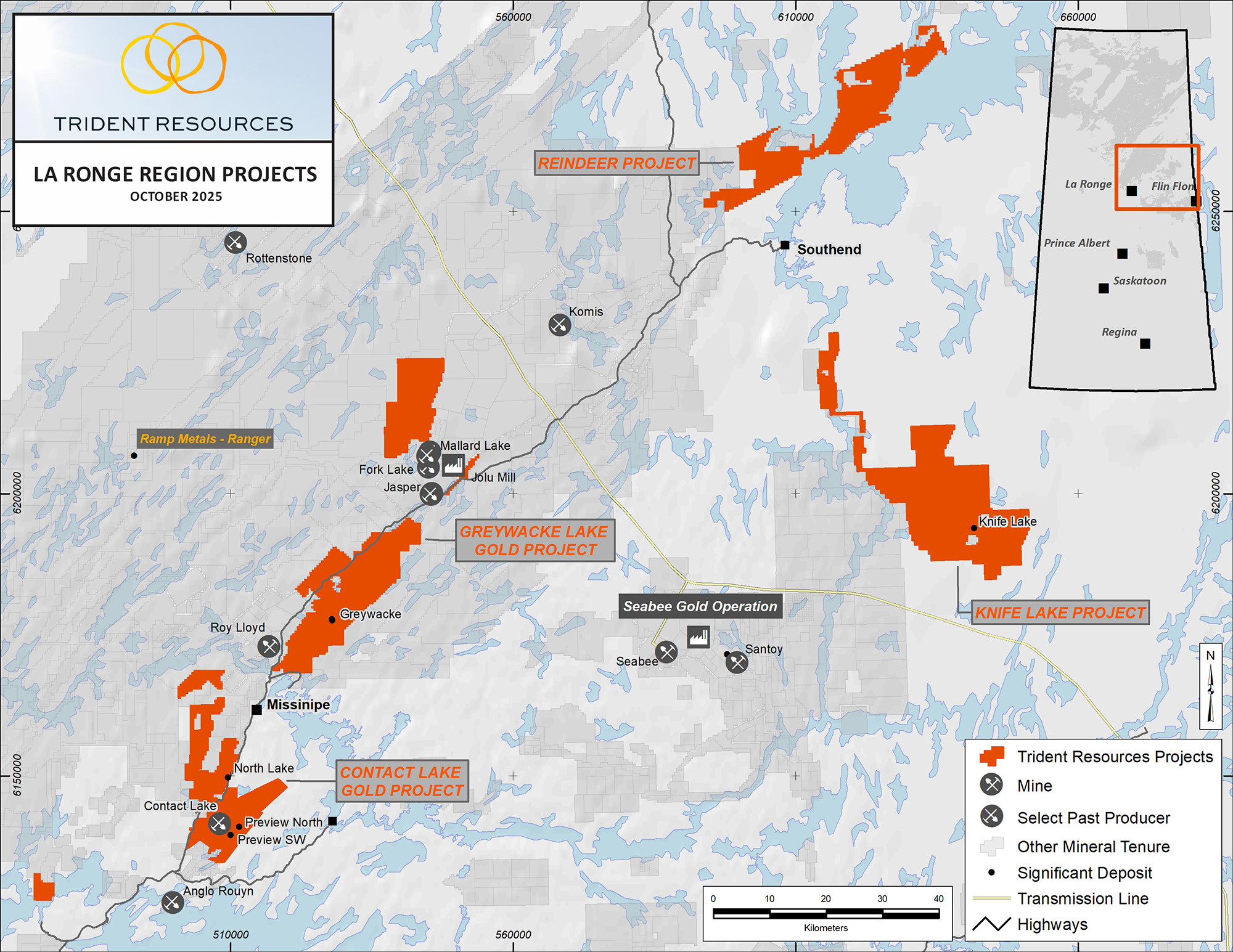

The Reindeer Project consists of 10 contiguous mineral claims totaling 29,000 hectares in northern Saskatchewan. The Property lies along the contact between the La Ronge and Kisseynew Domains of the Trans-Hudson Orogen, a prolific geological belt hosting multiple gold and base metals deposits. Importantly, the Property is cut by three strands of the Tabbernor Fault system, a major crustal structure that also hosts the Seabee Gold operations (with more than 2 million ounces of cumulative gold production).

Project Portfolio Map:

The Property is located near Highway 905, which services Cameco and Orano’s uranium operations at Rabbit Lake, McClean Lake, and Cigar Lake. The claims are in good standing until at least October 2027 and are not subject to any royalties.

Historical exploration has identified multiple gold, copper, zinc, and silver showings, including the Discovery Au Showing (0.16–0.60 oz/t Au in grab samples, Saskatchewan Mineral Deposit Index “SMDI” 0501) and the Rosie Showings (up to 0.77% Cu, 0.20% Zn, and 0.061 oz/t Au in grab samples, SMDI 0504). Numerous untested EM conductors across the property highlight the strong discovery potential, with the ground remaining largely underexplored despite its proximity to producing and past-producing mines.

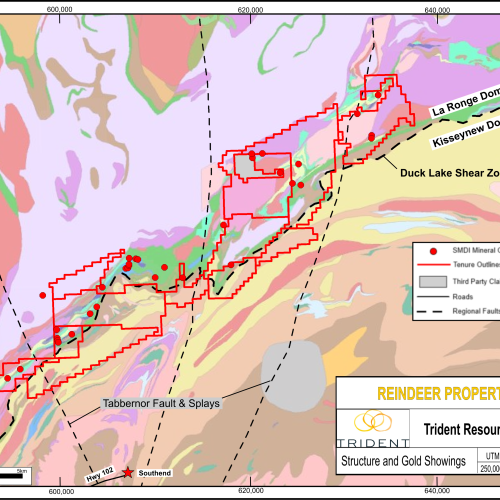

Geological Setting:

The property lies along the contact between the La Ronge and Kisseynew Domains of the Reindeer zone within the Trans-Hudson Orogen (THO) of northern Saskatchewan. The property is cut by three north trending splays of the Tabbernor Fault system, a major 1,500 km long crustal feature that hosts the Seabee & Santoy Gold operations (combined production of 2 million oz of Au).

The La Ronge Domain is an accreted volcanic arc complex of 1.92–1.86 Ga age, comprised of mafic to felsic volcanic rocks, sediments and felsic plutonic granitoid rocks affected by amphibolite to granulite facies metamorphism. The La Ronge domain is known to host numerous high-grade gold and base metals deposits. Examples are the Waddy Lake, Star/Jolu/Jasper, Contact Lake gold deposits and Brabant-McKenzie base metals deposits.

The Kisseynew Domain is a 1.84–1.82 Ga metasedimentary gneiss belt representing a deep marine back-arc basin or foreland basin that was subsequently deeply buried and metamorphosed. The belt is comprised of metasedimentary pelitic gneisses and psammites; greywacke and mudstone derived para-gneisses and local metavolcanic rocks and intrusives, affected by high-grade amphibolite to granulite facies metamorphism. The Kisseynew Domain is host to several Au and base metals occurrences, most notably Trident Resources Greywacke deposit, located 100 km southwest of the Reindeer property.

Mineralization:

There are numerous documented base and precious metals occurrences as well as multiple EM conductors identified along the length of the property and on adjacent properties.

Numerous notable occurrences on the Reindeer Property include the Discovery Au Showing (grab sample from a quartz flooded shear zone returned 0.16 to 0.6 oz/t Au) and the Rosie Showings, which returned up to 0.77% Cu, 0.2% Zn and 0.061 oz/t Au. There are also notable occurrences on adjacent properties including: the Henry Lake occurrence (17.2 g/t Au in semi massive sulfides); the Daiwan Main Zone (up to 0.17% Cu, 0.43% Zn and 0.2 oz/t Au); the Daiwan Han Zone (up to 6.6 g/T Au from a shear zone in mafic tuff).

Agreement Terms:

Under the terms of the Agreement, Trident may acquire up to a 100% interest in the Property through staged payments and share issuances as follows:

- First Option (50% interest): $35,000 in cash and 1,000,000 common shares of Trident (the “Shares”) on closing.

- Second Option (75% interest): An additional 500,000 Shares on or before the first anniversary of closing.

- Third Option (100% interest): An additional 500,000 Shares on or before the second anniversary of closing.

If Trident exercises less than the full 100% earn-in, the parties will form a joint venture to further advance the Property. The shares are subject to a statutory hold period of four months and one day from issuance. No finder’s fees are payable pursuant to the Agreement. The Agreement remains subject to the approval of the TSX Venture Exchange.